Bait & Switch: Property Tax "Relief" Bill Will Increase Your Taxes

Your local income taxes may increase by $1.1 billion each year.

Dear neighbor,

This week at the Statehouse, we’ve been working on Senate Bill 1—the majority’s plan for property tax relief. People’s property taxes vary by area, assessed value and more since a lot of variables are involved. Across the board, inflation has increased homeowners’ assessed values, doubling or tripling bills for some homeowners. House Democrats’ mission has been to help you cover these large increases.

On Wednesday, the House majority changed its plan. Their proposal still includes tax breaks for businesses, potential increases in local income taxes, insignificant savings for homeowners and diverting money to charters.

Here are my concerns with the updated version of Senate Bill 1, which passed out of the House on Thursday.

Concerns with the Majority’s Property Tax Proposal

67% of homeowners will see some savings on their property tax bill, with a maximum credit of $300. These savings will be balanced out with potential local income tax increases, and some homeowners will get no money off their bill but see a local income tax increase.

Local income taxes will potentially increase by $1.1 billion each year. Counties can impose a local income tax of 2.9%, and cities and towns can impose a rate of 1.2% within that 2.9%.

Young and lower-income individuals will be adversely impacted since they may not own a home but could see increases in their income tax.

Local governments will lose $1.4 billion. Police, fire, EMS, public libraries and other locally funded services will have their budgets gutted.

Allen County will lose $89.3 million by 2028.

Public schools will lose $744.4 million by 2028. The dollars they do get will be shared with charters in some school districts.

Schools won’t get a share of local income taxes, so they’ll be unable to recover the property tax revenue they’ll lose.

Fort Wayne Community Schools will lose $12.9 million over the next three years.

Businesses receive massive property tax cuts since they’ll be exempt from taxes on their equipment. Businesses also don’t pay local income taxes. Homeowners’ bills will cover the cost for big businesses.

No savings for renters or first-time homebuyers.

The bill phases out significant deductions that are currently in law for disabled veterans.

This bill is a tax hike in disguise, plain and simple. Our schools and public safety will be between a rock and a hard place—raise local income taxes or have their budget slashed. We still have no clue how federal funding changes will affect our state and local governments.

I’m thankful some Hoosiers might get some savings, but this bill falls short of curtailing property tax bill increases. This is not the best that we can do. House Democrats proposed over 20 changes to this bill. Our goal was to provide as many homeowners with relief as possible while preserving local services. All of our proposals were voted down.

House Democrats’ Attempt To Provide Relief

Providing an additional $300 to cover the expenses that come with home ownership, like insurance and utilities. Homeowners would get up to $600 a year.

Increasing the renter’s deduction from $3,000 to $5,000 for individuals.

Creating a first-time homebuyer’s tax deduction, so that young people can get a little relief in their first year in their new home. We also proposed a first-time homebuyers’ down payment grant program with awards of $25,000.

Freezing property tax bills for veterans with moderate to severe service-related disabilities.

Capping increases in the property tax bills of qualifying seniors at 1% each year.

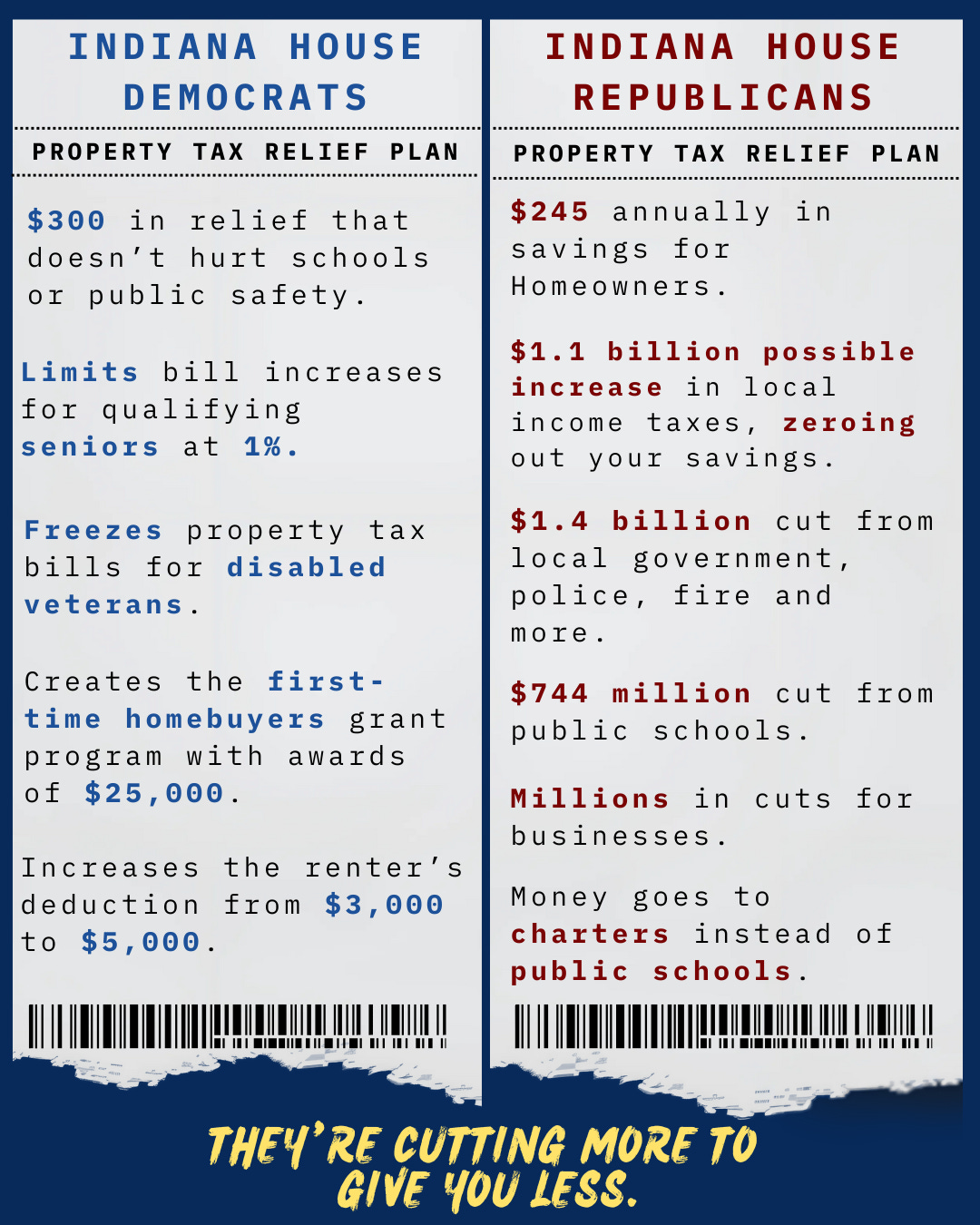

Here’s a side-by-side comparison of the two plans:

America is staring down a recession and stagflation thanks to the tariffs that have been put in place. This means the cost of clothes, food, and goods for working Hoosier families will wildly increase. Why are we forcing local governments to tax Hoosiers at a higher level? House Democrats have fought all session to lower the cost of living for Hoosiers, and this tax scam will do the exact opposite. Hoosiers need real relief, and SB 1 doesn't cut it.

The Senate has filed a motion to agree with the changes, so the bill will head to Gov. Mike Braun to sign or veto soon. House Democrats will continue fighting for lower taxes, property tax relief for those who need it and for the needs of our public schools, police, fire and EMS.

As always, please reach out to my office at h82@iga.in.gov with any questions, comments or concerns.

In service,

State Rep. Kyle Miller

With Federal taxes being cut there's only one place to recover the decrease is in the state. And each state will do their what they can to recover lost revenue. We should not let the Federal government slash needed funds so all states continue to receive funds needed for education and other country wide essentials.

Keep up the good work Kyle.

Keep fighting the good fight for us, Kyle. This is crazy! I'm 73 and still working as a nurse so I can afford to live. I'd love to actually retire soon. But it's just not looking good!